As we step into 2024, the Thailand property market stands at a pivotal junction, influenced by both global economic trends and local market dynamics. This outlook provides an overview of the key factors that are expected to shape the market in the coming year, including government policies, foreign investment flows, and the evolving demands of both local and international buyers. Amidst the backdrop of a recovering global economy, Thailand’s property market is showing signs of resilience and potential growth opportunities.

From the bustling cityscapes of Bangkok to the serene beaches of Phuket, we explore the diverse landscape of the Thai real estate sector, highlighting areas of growth, potential challenges, and emerging trends that stakeholders should watch. Whether you’re an investor, a developer, or a prospective homeowner, understanding the nuances of the 2024 outlook will be crucial in navigating the complexities of Thailand’s property market.

Table of Contents

Reflecting on the 2023 Thai Housing Market.

Reflecting on 2023, you’ll notice that the Thai property market displayed a significant shift towards low-rise developments, overtaking high-rise condo registrations in the first half of the year. This pivot highlights a fresh trend within the Thailand property market outlook, aligning with the changing preferences of homeowners and investors alike.

As you read through this Thai property forecast, it’s evident that the Bangkok property market has adapted to these new demands, focusing more on community-centric living spaces that cater to a desire for privacy and comfort. Similarly, the Phuket property market has capitalized on its appeal to both domestic and international buyers, offering a blend of luxury and serenity away from the urban sprawl.

The property market in Thailand has shown resilience and an ability to evolve, suggesting a robust future. While high-rise developments have traditionally dominated the skyline, the shift towards low-rise housing indicates a market responding to lifestyle changes and investment patterns.

Keep this trend in mind as you consider your next move in the Thai property sphere, whether you’re eyeing an urban investment in Bangkok or a coastal retreat in Phuket.

Overview of the Current Thai Economy

Thailand’s economy has been improving steadily, and it is expected to grow steadily in 2024 and is projected to pick up to 3.2% from 2.5% this year according to WorldBank.The key economic indicators that may impact the real estate market include the following:

- GDP growth rate: The World Bank predicts that Thailand’s GDP will grow by 4.4% in 2024, up from 2.5% in 2023, which could lead to increased demand for real estate.

- Inflation rate: Thailand’s Ministry of Commerce predicted headline inflation for 2024 to be between minus 0.3% and 1.7%. The Bank of Thailand, however, expects inflation to turn positive in the first quarter of 2024, forecasting full-year inflation of 1.3% in 2023 and 2% in 2024, within its target range of 1% to 3%.

- Unemployment rate: In 2024, Thailand’s unemployment rate is expected to be around 1.10%, with approximately 0.44 million individuals forecasted to be without employment. Concurrently, the employment rate is projected to reach 67.36%, highlighting robust participation in the labor market. The total labor force within the country is anticipated to stand at 40.25 million, indicating a dynamic and active workforce for the year.

How is the property market in Thailand currently?

As you consider the developing landscape of the Thai property market, it’s important to recognize its current state, which is characterized by a dynamic shift towards more low-rise housing developments and a continued demand for residential properties. This trend is reflected in several key aspects:

- Surge in Low-Rise Developments: Buyers are increasingly attracted to the privacy and space offered by single-detached houses and townhouses.

- Steady Residential Demand: Despite global uncertainties, there’s a steady appetite for homes, driven by local buyers and long-term investors.

- Condominium Market Adjustment: The condo market is adjusting, with developers slowing down new launches and focusing on clearing existing inventories.

- Infrastructure Influence: Ongoing infrastructure projects, especially in transportation, are impacting property values and investment decisions.

- Tourism & Economy Interplay: The gradual recovery of tourism and a resilient economy is buoying confidence in the Pacific real estate market outlook for Thailand’s property sector.

Your understanding of these trends is vital in navigating the market. Whether you’re looking to invest or find a home in Thailand, staying informed will help you make decisions that align with current market realities and future growth potential.

Is Thailand's Economy Going To Improve in 2024?

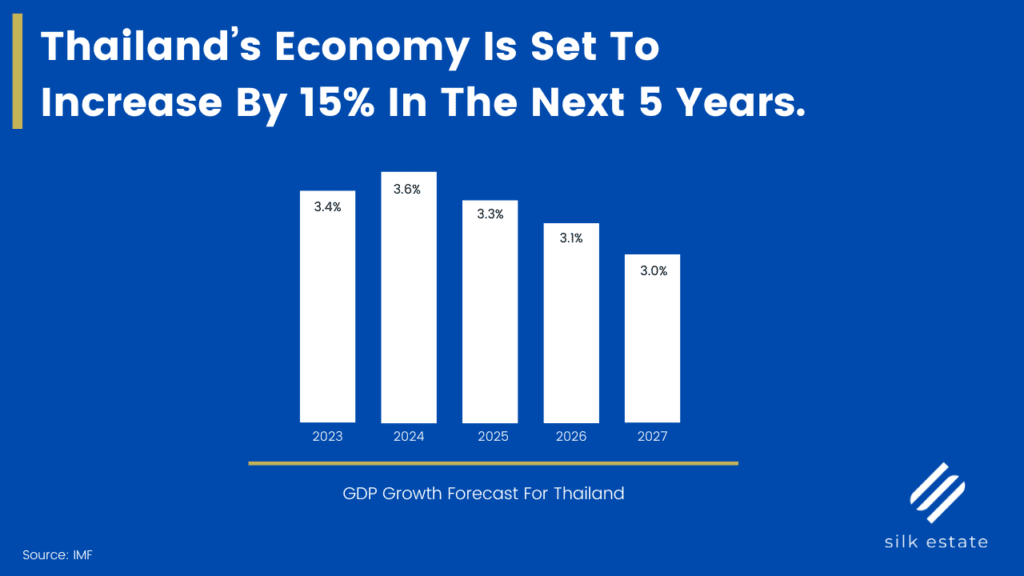

Thailand’s economy is set to grow, with forecasts indicating a growth rate of 3.4% in 2023 and 3.6% in 2024. You’re witnessing a nation on the upswing, where political and social stability lay a strong foundation for your investments. With a Fragile State Index score of 70, you can invest with confidence, knowing that the Thai government’s efforts to bolster the economy and reduce inequality are creating a conducive environment for property market growth.

You’ve got to consider the long game here. Though rental yields mightn’t seem impressive at first glance – ranging from 1.5% to 4.2% – the real allure lies in the anticipated appreciation of property values. It’s not just about immediate cash flow; it’s the sustainable increase in your asset’s worth that should catch your eye.

Moreover, with moderate inflation and strategic advantages projected for 2024, you’re looking at a prime time to dive into the Thai property market. Align your financial goals with these growth trends and you’ll find yourself in a position to capitalize on a market brimming with potential.

Thailand Inflation and Demographics

While considering the robust growth and stability that set the stage for investment, it’s also essential to examine how inflation and demographic trends could influence the Thai property market’s trajectory. You’ve got to consider the impact of inflation on your investment’s purchasing power. A moderate inflation rate can benefit the property market as it often leads to rising property values but don’t forget the flip side—too much inflation could hurt affordability and demand.

Demographics play a crucial role too. You’re looking at a population that’s aging, which means the demand for certain types of properties, like retirement homes, may increase. However, a shrinking workforce could slow down economic growth, which might affect property prices.

Here’s a quick rundown of what you should keep tabs on:

- Inflation Rates: Moderate inflation is anticipated, but stay vigilant about any unexpected rises.

- Population Growth: It’s slowing down; understand how this could impact demand.

- Aging Demographics: Prepare for potential shifts in market needs.

- Economic Impact: A smaller workforce may influence economic expansion and property values.

- Property Demand: Consider how demographic changes will alter which property types are in demand.

Keep these factors in mind as they’re bound to shape the property market in Thailand this year.

Assessing Rental Yields in Thailand

When you’re evaluating the potential returns on property investments in Thailand, rental yields are a key indicator to consider. Rental yields, which represent the annual rental income as a percentage of the property’s value, vary across the country. Rental Yields range from 5.79% (Q4, 2023). Previously in Q2 of 2023, it stood at 6.07% and this could rise slightly further in 2024. This suggests that while you won’t find sky-high returns on rent alone, the stability and growth in the Thai property market could balance the scales.

You must weigh the lower rental yields against the potential for long-term capital appreciation. Property values have been steadily increasing, which might make up for the modest income from renting out your property. It’s also essential to keep in mind that these figures can differ significantly based on location, property type, and market conditions.

As you consider your investment strategy in Thailand, focus on long-term growth prospects rather than immediate rental returns. With Thailand’s economy projected to grow or stay in a similar situation with the government’s efforts to enhance stability, investing in property here could be a strategic decision if aligned with your financial goals and risk tolerance. Remember, the key is to assess all factors thoroughly to make an informed investment decision.

4 years later: The Pandemic Market Resilience

Despite the global upheaval caused by the pandemic, the real estate market in Thailand showed remarkable resilience, buoyed by government measures and the nation’s strong economic fundamentals. You’ve witnessed a sector that didn’t just survive; it adapted and thrived amidst the challenges.

Here’s how:

- Government Stimulus: The Thai government rolled out incentives, including tax breaks and soft loans, which cushioned the market from potential collapse.

- Low-Interest Rates: The Bank of Thailand cut interest rates to historic lows, making mortgages more affordable and stimulating demand.

- Flexible Developers: Developers offered discounts and flexible payment terms, attracting buyers despite economic uncertainties.

- Domestic Demand: The market relied heavily on domestic buyers, as travel restrictions limited foreign investment.

- Shift in Preferences: Demand increased for properties with more space and amenities, reflecting changes in work and lifestyle patterns.

These strategic moves created a safety net for the property market. You’re looking at a real estate landscape that hasn’t only shown its durability but is also poised for future growth.

Now’s the time to keep a close eye on this market as it continues to navigate the post-pandemic world.

House prices in Thailand keep increasing, month after month

Reflecting the resilience of Thailand’s property market during the pandemic, house prices have continued to rise steadily each month. You’re witnessing a market that’s defying the odds, with each report outdoing the last in terms of growth. This trend isn’t just a short-term spike—it’s become the norm as the Thai property landscape marches forward.

You might wonder what’s fueling this surge. It’s a mix of robust economic forecasts, political stability, and strategic government measures aimed at supporting the real estate sector. The government’s initiatives have been particularly effective, providing a safety net for the market during uncertain times.

As you consider diving into this market, remember that with rising house prices, the value of your investment could likely appreciate over time. However, don’t overlook the rental yields, which are modest in comparison. While immediate income mightn’t be high, the long-term gains from property appreciation seem promising.

It’s essential to keep in mind the bigger picture. Though individual factors like a declining population might raise concerns, the overall economic growth and the upward trend in house prices suggest a different story—one where the potential benefits outweigh the risks.

Trends in Overseas Investment in Thailand Property

The landscape of Thailand’s property market is increasingly shaped by diverse overseas investments, with trends revealing a broader range of international players entering the scene. You’ll find that despite global economic uncertainties, Thailand remains a magnet for foreign capital looking for promising real estate ventures.

Here’s what you should watch out for:

- New Entrants: More investors from countries beyond the typical Asian powerhouses like China and Japan are showing interest.

- Strategic Locations: There’s a clear focus on hotspots like Bangkok and Phuket, where infrastructure developments boost potential returns.

- Diversified Portfolios: Investors aren’t just eyeing residential properties; commercial and hospitality sectors are also on their radar.

- Long-Term Growth: Many see Thailand as a long-term play, with the expectation that property values will continue to climb steadily.

- Regulatory Environment: The Thai government’s easing of regulations for foreign investors is making the Asia Pacific real estate market more accessible.

As you consider tapping into Thailand’s property market, it’s crucial to stay informed about these evolving trends. They’re not just reshaping the investment landscape but also opening up new opportunities that could align well with your investment goals.

Key Opportunities for Foreigner Property Investors

Foreign investors often find lucrative opportunities in Thailand’s property market, particularly in sectors like residential, logistics, and hospitality. As you consider dipping your toes into this vibrant market, keep in mind the stable economic growth forecasted for Thailand. With a projected GDP increase of 3.4% in 2023 and expected growth in 2024, there’s a buzz around the potential for real estate appreciation in Thailand’s residential market in the long term.

Don’t be deterred by the modest rental yields, ranging from 1.5% to 4.2%. Instead, focus on the bigger picture where the growth in property values may well compensate for these figures. Whether you’re eyeing a sleek Bangkok condo or a charming Chiang Mai villa, the residential market’s resilience, demonstrated even during the pandemic, hints at a wise investment choice.

The diversification of investment opportunities is expanding. Beyond the traditional, you can explore flourishing sectors like retirement communities and hospitality properties, catering to Thailand’s growing demand for these services. It’s about being strategic—2024 could be your year to make a mark. Align your investments with regions showcasing strong economic prospects and lean on experienced local partners to navigate the nuances of the Thai market.

There’s a wealth of opportunity waiting for you in the Land of Smiles.

Real Estate Sector Overview in Thailand

When you look into Thailand’s real estate sector, you’ll find it contributes about 10% to the nation’s GDP, with residential properties taking the lion’s share. This vibrant market segment is underpinned by a combination of factors that you should weigh when considering your investment options:

- Stable Political Climate: This is vital for the health of the real estate market, reassuring you that your investments are secure.

- Economic Growth: The nation’s economy is on an upward trajectory, potentially increasing property values over time.

- Diverse Property Types: Whether you’re eyeing commercial spaces or residential dwellings, there’s a variety of options to suit your portfolio.

- Foreign Investment Incentives: Policies favoring foreign investors can make Thailand an attractive market for your overseas assets.

- Urbanization and Infrastructure Development: As cities expand and infrastructure improves, previously overlooked areas may become hotspots, offering you a chance to get in early.

Keep in mind, that the Thai property market is nuanced and dynamic. It’s essential to stay informed, considering both the macroeconomic indicators and the specific details of the local markets where you’re looking to invest.

With prudent analysis and a strategic approach, you can position yourself to take advantage of the opportunities that Thailand’s real estate sector has to offer.

2024 Strategic Investments in Thailand

Building on the robust foundation of Thailand’s real estate sector, let’s explore four strategic investment opportunities that could maximize your portfolio’s potential. With the economy expected to grow steadily, now’s a great time to consider these avenues.

First, look into key cities with strong economic growth prospects. Cities like Bangkok, Chiang Mai, and Phuket offer resilient sectors ripe for investment. Investing in residential properties, logistics facilities, and data centers in these areas could provide long-term value appreciation.

Secondly, don’t overlook alternative options such as retirement and hospitality properties. These sectors are gaining traction and cater to Thailand’s developing economy and aging population, offering diversification from traditional real estate investments.

Third, keep an eye on overseas investment trends. As foreign interest from China, Singapore, and beyond grows, there’s potential to benefit from diversification and increased market stability.

Lastly, consider the strategic advantage 2024 seems to hold for entering the Thai property market. Weigh your objectives and risk tolerance against the current market signals, and align your choices with your financial goals.

With careful assessment, you’ll be well-positioned to capitalize on the opportunities that Thailand’s property market presents.

Political and Social Stability

While rising house prices may capture your attention, it’s the underlying political and social stability in Thailand that ensures your investment can thrive over the long term. You’re looking at a country that boasts a score of 70 on the Fragile State Index, indicative of its resilience and steady governance. This stability isn’t just a backdrop; it’s a key player in the success of your real estate ventures.

The Thai government isn’t resting on its laurels either. It’s actively chipping away at inequality and fortifying democratic institutions to create a more equitable society. For you, this means a secure investment climate and peace of mind about the safety of your assets. You don’t need to take anyone’s word for it; a glance at official reports and government statistics will show you that now’s a good time to dive in.

Thai business owners hold a neutral outlook toward market conditions, signaling neither excessive optimism nor pessimism. This neutrality is a steady hand on the tiller for the property market. As you consider your next move, remember that a stable political and social environment isn’t just desirable, it’s essential for the long-term appreciation of your investment.

Diversifying Investment Options in Thailand

Building on the momentum of Thailand’s economic growth projections, investors are now widening their scopes to include emerging sectors like logistics facilities and niche residential options. You’re no longer limited to the traditional residential and commercial properties.

With Thailand’s economy poised for expansion, opportunities in logistics are booming due to the surge in e-commerce. Likewise, the retirement and hospitality sectors are growing, offering promising alternatives for your portfolio.

You’re looking at a property market that’s diversifying rapidly. It’s not just about the classic condos or office spaces anymore. You’ve got data centers, retirement communities, and specialized residential developments that cater to a changing demographic. This diversification reflects the evolving needs of Thailand’s economy and provides a hedge against market fluctuations.

The key for you is to align these investment opportunities with your financial goals. You’ll want to research and possibly partner with local experts who understand the nuances of these new sectors. Remember, it’s not just about jumping on a trend. It’s about careful consideration of where the market is headed and how these emerging sectors fit into the broader economic landscape of Thailand.

Is it a Good Time to Buy Real Estate in Thailand?

Considering the current economic stability and growth prospects now may be a good time to invest in Thai real estate. You’re likely looking for compelling reasons to make a move, and the following factors could be just what you need to inform your decision:

- Economic Growth: Thailand’s economy is on an upward trend, which could enhance property values over time.

- Stability: With a stable political climate, your investment is less likely to face turbulence due to unforeseen policy changes or social unrest.

- Market Trends: Positive housing market trends suggest a growing demand for properties, potentially leading to higher rental yields and capital appreciation.

- Diversification: A range of property types, from urban condos to beachfront villas, means you can find an investment that suits your portfolio.

- Strategic Timing: As the property market remains in recovery from the pandemic in the Asia Pacific real estate market, you have the opportunity to get in before prices potentially rise further.

Keep in mind, though, that while these factors are encouraging, real estate investments carry inherent risks. You’ll want to conduct thorough research and possibly consult with a local expert to align this opportunity with your financial goals.

Frequently Asked Questions

How Do Environmental Policies and Climate Change Impacts Factor Into the Long-Term Sustainability of Property Investments in Thailand?

You should consider how environmental policies and climate change might affect your property’s long-term value and sustainability before investing in Thailand’s real estate market.

What Are the Implications of Thailand's Smart City Initiatives on Future Property Values in Urban Areas?

You’ll find that Thailand’s smart city initiatives may increase property values in urban areas by improving infrastructure, technology, and quality of life, making these locations more attractive for living and investing.

How Does Thailand Handle Property Ownership Disputes, Particularly Those Involving Foreign Investors, and What Legal Recourse Is Available?

In Thailand, if you’re facing property ownership disputes, especially as a foreign investor, you’ve got legal recourse through negotiation, arbitration, or the judicial system to resolve issues and protect your investments.

Are There Any Anticipated Changes to the Tax Structure for Property Owners in Thailand That Might Affect Future Investment Returns?

You should keep an eye on government updates, as changes to tax laws could impact your property investment returns in the real estate market in Thailand, but no significant tax structure changes have been announced yet.

How Might Evolving Technology, Such as Blockchain and Smart Contracts, Influence the Process of Buying and Selling Property in Thailand in the Near Future?

Evolving technology like blockchain and smart contracts could streamline your property transactions in Thailand, making them more secure, transparent, and efficient. It’s a game-changer for buying and selling real estate. Though using blockchain and other technologies similar are not well used currently.

Previous Property Market Reviews

Ready to Invest in Thailand?

Contact us today to start your search for the perfect property in Thailand.